DEO UCB-231 2012-2025 free printable template

Show details

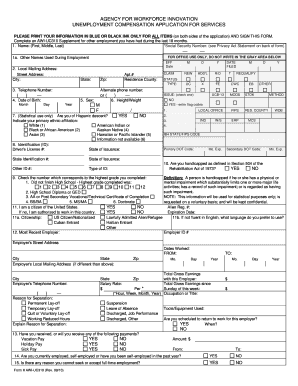

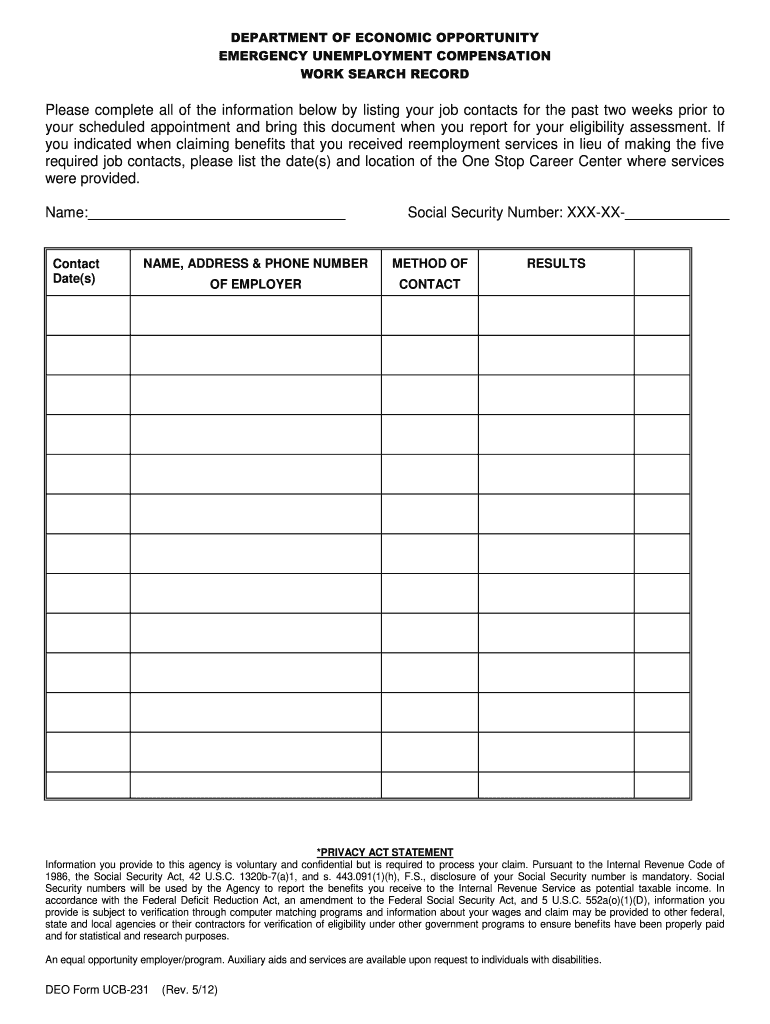

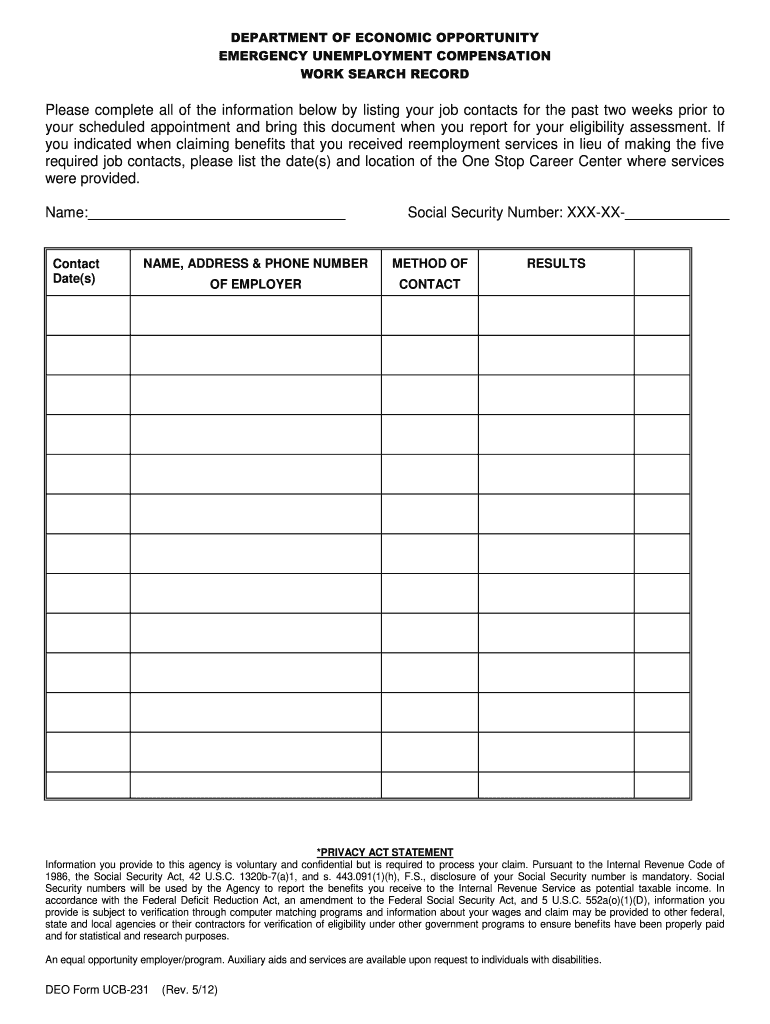

This document is used to record job contacts made by individuals seeking unemployment benefits as part of their eligibility assessment.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign deo form ucb

Edit your deo unemployment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deo reemployment assistance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit floridadeo online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit deo reemployment form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deo form ucb 11

How to fill out DEO UCB-231

01

Obtain the DEO UCB-231 form from the official website or designated office.

02

Fill in the personal information section, including your name, address, and contact details.

03

Provide any required identification numbers, such as Social Security Number or Tax ID.

04

Complete the sections related to the purpose of the application, ensuring to check the appropriate boxes where necessary.

05

If applicable, attach any supporting documentation required for your application.

06

Review the form for completeness and accuracy.

07

Sign and date the form at the designated area.

08

Submit the completed form either online, by mail, or in person as instructed.

Who needs DEO UCB-231?

01

Individuals applying for certain government services or benefits may need to fill out the DEO UCB-231.

02

Employers filing for unemployment claims on behalf of their employees may also require this form.

03

Anyone seeking to comply with specific regulatory requirements that mandate the use of this form.

Fill

deo unemployment assaistance ra

: Try Risk Free

People Also Ask about deo unemployment paper form

Do business owners have to pay unemployment on themselves in Michigan?

Self-employed individuals are not listed as employees. If you are self-employed, you do not pay into the unemployment system for yourself.

Can a business owner collect unemployment in NJ?

If you operate a part-time corporate business while you are employed full-time, you may be entitled to unemployment benefits if you lose your full-time job. This is because you would be able to establish a claim based on your full-time work (your earnings with the corporation would not be included on your claim).

What disqualifies you for unemployment in Ohio?

Unemployment insurance is available for individuals who are unemployed due to no fault of their own. Generally, those who voluntarily leave a job are not eligible for unemployment. Someone who was terminated for cause – for example, for violating company policy – would not be eligible for unemployment compensation.

Who pays for unemployment benefits in Ohio?

Unemployment benefits are financed by taxes paid by employers to the federal and state governments. The federal taxes cover most of the program's administrative costs. The state taxes fund the actual benefits.

Can LLC owner collect unemployment in PA?

You may be ineligible for benefits if you are self-employed, setting up a business, or have ownership interest in a business.

Can LLC owner collect unemployment in Ohio?

For an LLC owner to qualify for unemployment, they must meet certain requirements. These include: The LLC must be a qualified employer that pays into federal and state unemployment tax programs. Owners must be employed by the company as a W-2 employee and must have filed federal taxes as an employee of the company.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute unemployment compansation claim aqpplication online?

pdfFiller has made filling out and eSigning post office forms for unemployment easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit how to get unemployment benefits online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your print and mail unemployment form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for signing my business owner form for unemployment in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your prent form for unemployment and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is DEO UCB-231?

DEO UCB-231 is a form used for reporting employment and wage information to the Department of Employment and Organizations. It serves as a record for compliance with labor laws.

Who is required to file DEO UCB-231?

Employers, including businesses and organizations that pay wages to employees, are required to file DEO UCB-231.

How to fill out DEO UCB-231?

To fill out DEO UCB-231, employers should provide details such as their business information, employee wage information, and any applicable employment dates.

What is the purpose of DEO UCB-231?

The purpose of DEO UCB-231 is to collect data on employment and wage trends, which helps in the administration of unemployment insurance and workforce development programs.

What information must be reported on DEO UCB-231?

Information that must be reported on DEO UCB-231 includes the employer’s business name, address, total number of employees, and wage records for each employee.

Fill out your DEO UCB-231 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Unemployment For To Print is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.